Question 1

- In the following cases, record Journal Entries for amortization in the books of Huge Ltd. for the year ended 31st March, 2024 with reference to AS-26:

(i) The company had acquired Patent Rights for Rs. 340 lakhs on 01.04.2022. The estimated product life is 4 years. Amortization was decided in the ratio of estimated future cash flows which are as under:

1st Year Rs. 140 Lakhs

2nd Year Rs. 350 Lakhs

3rd Year Rs. 280 Lakhs

4th Year Rs. 420 Lakhs

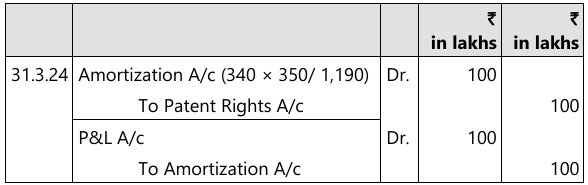

(ii) The company had developed know-how by incurring expenditure of Rs. 80 lakhs. The know-how has been used by the company since 01.04.2018. Its useful life is 8 years from the year of commencement of its use. The company has not amortised the asset until 31.03.2024.

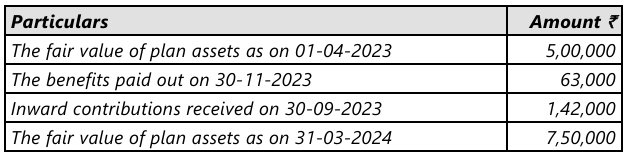

(b) Pendora Ltd. has given the following details in respect of employee benefit pension plan:

On 01.04.2023, the company made following estimates, based on its market studies and prevailing prices :

You are required to find the expected and actual returns on plan assets as on 31.03.2024 as per AS 15.

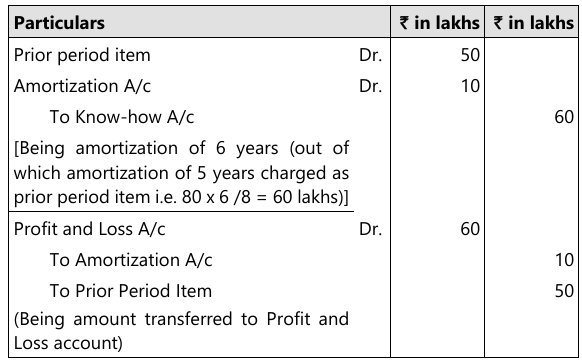

(c) Delta Ltd. is working on different projects those are likely to be completed within 3 years period. It recognizes revenue from these contracts on Percentage of Completion Method for Financial Statements for the years ending 2021, 2022 and 2023 for Rs. 34 Lakhs, Rs. 50 Lakhs and Rs. 65 Lakhs respectively.

However, for Income Tax purpose, it has adopted the Completed Contract Method under which it has recognized revenue of Rs. 30 Lakhs, Rs. 52 Lakhs and Rs. 67 Lakhs for the years ending 2021, 2022 and 2023 respectively.

Income Tax rate is 30%.

Compute the amount of Deferred Tax Asset / Liability and Total Tax Expenses for the years ending 31st March 2021, 2022 and 2023.

Answer

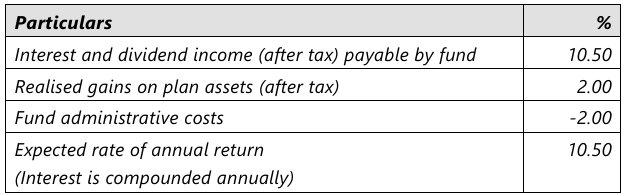

(a) (i) Journal Entry for the year ended on 31st March 2024

Working note

Huge Limited amortised Rs. 340 lakhs during next 4 years on the basis of net cash flows arising of the product. The amortisation for second year will be worked out as under:

Rs. 340 x 350 /1,190 (140+350+280+420) = Rs. 100 lakhs

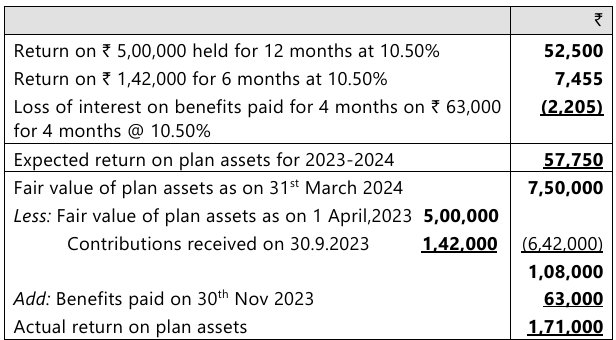

(b) Computation of Expected and Actual Returns on Plan Assets

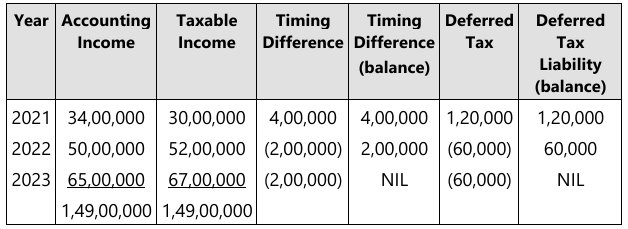

(c) Calculation of Deferred Tax Asset/Liability in Delta Limited

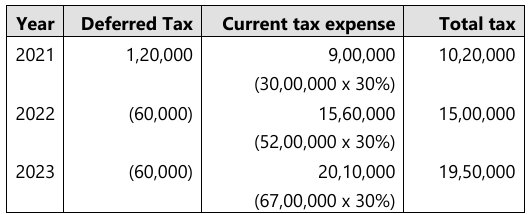

Calculation of total tax

Note: It is assumed that the revenue and the taxable profit is the same.